How-To Tutorials & Troubleshooting

How to Write a Check: A Complete Step-by-Step Guide for Beginners

In today’s digital age, online banking, credit cards, and mobile wallets are widely used. Still, writing a check remains an important financial skill. Many landlords, schools, small businesses, or government offices still accept or even prefer checks. Whether you’re opening a bank account for the first time or simply need a refresher, this guide will help you understand how to write a check clearly and correctly.

This article explains every part of a check, step-by-step instructions, common mistakes to avoid, safety tips, and a sample check. Even if checks seem old-fashioned, knowing how to write one is essential for financial literacy.

Why Do People Still Use Checks?

Even though digital payment systems are fast and convenient, checks are still used across many countries for several reasons:

- Checks provide written proof of payment.

- They are useful for large transactions without carrying cash.

- Many landlords, utility companies, and schools still accept checks.

- In some countries, checks are the main method for business payments.

- They can be post-dated to schedule payments in the future.

So, learning this simple skill can save you from confusion in many situations.

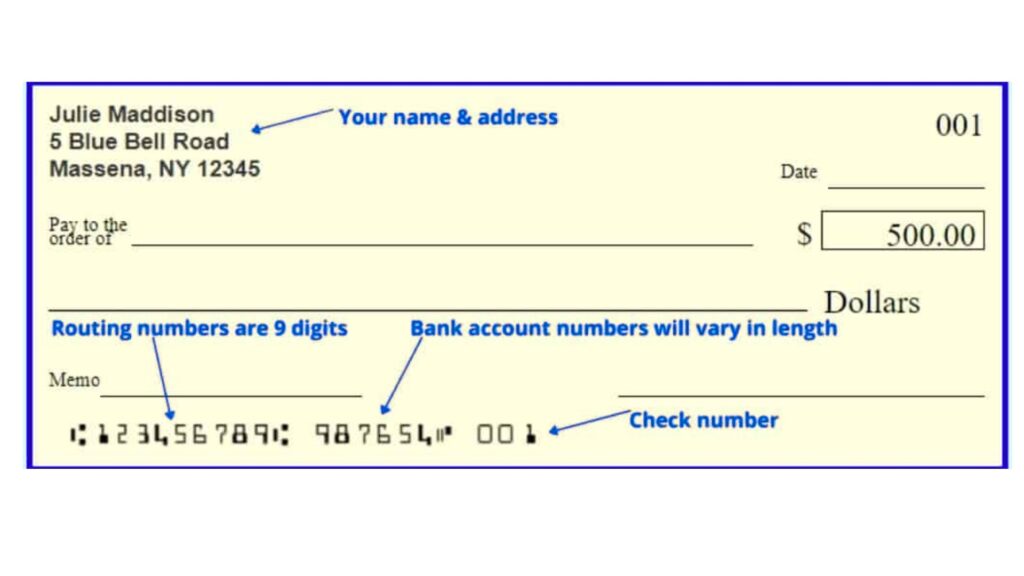

Parts of a Check You Need to Know

Before you start writing a check, it’s important to understand every field on it. While designs differ from country to country, most checks include the following parts:

1. Date Line

This is where you write the date when the check is issued. It can be written in different formats depending on your country, such as:

- 20 October 2025

- 10/20/2025

- 20/10/2025

2. Payee Name Line

Here, you write the name of the person, company, or organization that will receive the money. You can write:

- A personal name (e.g., John Smith)

- A business name (e.g., City Water Services)

- Yourself, if you are writing a check to withdraw money

3. Amount in Numbers

This box or small line is where you write the amount in numbers, for example, 250.00 or 1,500.50.

4. Amount in Words

This line is very important because the amount written in words is legally considered the official payment amount. For example:

- Two hundred fifty dollars and 00 cents

- One thousand five hundred rupees only

Writing the amount in words prevents anyone from secretly adding extra numbers.

5. Memo or For Line

This section is optional. You can write why the check is being given, such as:

- Rent for October

- Payment for school books

- Invoice No. 4567

6. Signature Line

This is where you sign the check. Without your signature, the bank will not process the payment.

7. Bank Information and Account Details

At the bottom of the check, there are printed numbers that include:

- Your bank’s routing or branch code

- Your account number

- The check number

These numbers help the bank process your payment.

Step-by-Step: How to Write a Check

Now that you understand the parts of a check, let’s go through each step clearly.

Step 1: Write the Date

Use the correct format based on your country, such as DD/MM/YYYY or MM/DD/YYYY. Always write the full date, not just the month and year. You can also post-date a check if you want the payment to be processed later.

Example: 26 October 2025

Step 2: Write the Payee Name

Write the full name of the person or company receiving the money. Make sure the name is spelled correctly and clearly. If you are unsure of the exact name of a business, check their invoice or receipt.

Example: Green Valley School

Step 3: Write the Amount in Numbers

In the small box, write the exact amount using digits. Include decimals even if it’s a whole number.

Example: 3500.00

Step 4: Write the Amount in Words

On the longer line, write the amount in words. Start writing from the far left side to prevent anyone from adding extra words. Use the word “only” at the end if no cents or paisa are included.

Example: Three thousand five hundred dollars only

Step 5: Fill in the Memo Line (Optional)

You can skip this part if you want. But adding a description helps you and the payee keep records.

Example: School fee for November

Step 6: Sign the Check

Use the same signature that your bank has on file. If the signatures do not match, your bank may reject the check.

Sample Check Format

Date: 26 October 2025

Pay to the Order of: Green Valley School

Amount in Numbers: 3,500.00

Amount in Words: Three thousand five hundred dollars only

Memo: School fee for November

Signature: [Your Name]

Common Mistakes People Make While Writing a Check

- Leaving blank spaces that allow others to add extra words or numbers.

- Incorrect spelling of the payee’s name.

- Writing the wrong date or forgetting the year.

- Writing different amounts in numbers and words.

- Forgetting to sign the check.

- Using pencil instead of pen. A check should always be written in pen.

- Damaging or tearing the check, which may cause it to be rejected by the bank.

How to Cancel or Void a Check

If you make a mistake, don’t panic. Just write the word “VOID” across the entire check. Then tear it or keep it safely so no one else uses it. Never throw a voided check in the trash without destroying it.

Safety Tips for Writing Checks

- Always keep your checkbook in a safe place.

- Never leave empty spaces in the amount lines. Draw a line after writing the value.

- Do not pre-sign blank checks.

- Use dark-colored ink pens to avoid someone washing and rewriting the check.

- Regularly check your bank statements to ensure no unauthorized checks have been cashed.

- If a checkbook is lost or stolen, immediately report it to your bank.

What Happens After You Write a Check?

When you give someone a check:

- The payee deposits it in their bank.

- The bank sends the check to your bank for approval.

- Your bank verifies your signature, available balance, and account details.

- If everything is correct, the money is deducted from your account and transferred to the payee’s bank account.

This process may take a few hours or several days, depending on the country and banks involved.

Frequently Asked Questions

Can I write a check to myself?

Yes. Write your own name as the payee. You can then deposit the check in another account or cash it.

What if I make a mistake?

Simply write “VOID” across the check and write a new one.

What is a post-dated check?

A post-dated check is written with a future date. The bank will only process it on or after that date.

What does “Not Negotiable” mean on a check?

It means the check cannot be transferred to another person and can only be paid to the person whose name is written on it.

Can I use correction fluid (white-out) on a check?

No. Banks usually reject checks with any signs of correction. It’s better to void the check and write a new one.

Final Tips to Remember

- Always write neatly and clearly.

- Keep a record of every check you write.

- Double-check the date, payee name, and amount before signing.

- Never share your checkbook or bank details unnecessarily.

- When in doubt, ask your bank for guidance.