Business

FinTech 2025: The Future of Money Is Already Here

FinTech 2025 Future of Money the way we handle money is changing faster than ever before. In 2025, financial technology the future of money or FinTech 2025 isn’t just disrupting traditional banking; it’s redefining how we save, spend, invest, and transfer money. From AI-driven investment platforms to decentralized finance (DeFi) and instant cross-border payments, the future of money isn’t some distant vision it’s already in our hands.

Consumers now expect speed, security, and personalization in every financial transaction, while businesses demand smarter, data-driven solutions to stay competitive. This rapid evolution is creating a new global financial ecosystem one where banks, startups, and tech giants are all racing to innovate.

In this article, we’ll explore the biggest FinTech trends shaping 2025, the technologies making them possible, and how they’re transforming everyday life for individuals and businesses alike.

In the past decade, we’ve seen the humble bank branch give way to mobile apps, crypto exchanges, robo-advisors, and peer-to-peer lending platforms. Your grandparents may have balanced checkbooks; you probably balance your Venmo, PayPal, or digital wallet instead. The way things are going, The Future of Money Is Already Here might never step into a bank at all.

What Is FinTech, Really?

At its core, FinTech means using technology to improve financial services. But that’s a little broad, so let’s unpack it.

- Traditional Finance: Banks, credit unions, insurance companies, and stock exchanges have existed for centuries. They were built on paper processes, face-to-face interactions, and manual approvals.

- FinTech: Takes those same services and more and makes them faster, cheaper, more accessible, and often more transparent using technology.

This can be as simple as a budgeting app on your phone, or as complex as blockchain-powered decentralized finance (DeFi) platforms.

Some examples you might already use:

- Paying for coffee with Apple Pay or Google Pay.

- Splitting dinner bills on Venmo.

- Sending money abroad via Wise (formerly TransferWise).

- Investing spare change using Acorns or Robinhood.

- Buying cryptocurrency on Coinbase or Binance.

In short: If you’ve moved money without physically handing over cash or filling out a paper form, you’ve already experienced FinTech.

The Origins of FinTech

While the term feels modern, FinTech has roots that stretch back decades. The first wave came in the 1950s with credit cards. Then came ATMs in the 1960s, electronic stock trading in the 1970s, and online banking in the 1990s.

The real explosion happened after the 2008 financial crisis. People lost trust in traditional banks, while smartphones and high-speed internet became part of daily life. This created the perfect storm for tech entrepreneurs to jump into finance — with fresh ideas and fewer old-school restrictions.

Why FinTech Is Booming Now

Several factors have fueled the FinTech surge:

1. Smartphones Everywhere

Billions of people now carry powerful computers in their pockets. This means financial services can reach anyone, anywhere, anytime no bank branch required.

2. Lower Barriers for Startups

Cloud computing, open-source software, and app stores make it cheaper and faster to launch new services.

3. Changing Consumer Expectations

We’ve gotten used to instant results from apps like Uber, Amazon, and Netflix. Why should sending money or applying for a loan still take days or weeks?

4. Global Connectivity

Cross-border payments, remote work, and global e-commerce demand payment systems that are fast and borderless.

5. Regulatory Changes

Some countries have updated their banking laws to encourage innovation, creating “sandboxes” where startups can test products without full licensing.

The Main Categories of FinTech

FinTech is an umbrella term — and under it, you’ll find a variety of sub-industries. Let’s explore the major ones.

1. Digital Payments

Digital payments are the heart of FinTech.

Think PayPal, Stripe, Square, Apple Pay, and even your bank’s own mobile app.

Why it matters:

- Speed: Payments happen in seconds, not days.

- Accessibility: No need to carry cash or even a physical card.

- Global reach: Send money anywhere in the world instantly.

Fun fact: In countries like China, cash is nearly extinct in major cities thanks to Alipay and WeChat Pay.

2. Personal Finance & Budgeting

Apps like Mint, YNAB (You Need A Budget), and Pocket Guard help users track spending, set savings goals, and avoid overdrafts. These tools are replacing the need for personal finance spreadsheets and manual tracking.

3. Lending & Credit

Gone are the days when you needed to walk into a bank, fill out a pile of forms, and wait weeks for a loan decision. FinTech lenders like Lending Club, SoFi, and Upstart can approve loans within hours — using AI to assess creditworthiness, not just a credit score.

4. Investment & Wealth Management

Robo-advisors like Betterment and Wealthfront use algorithms to build and manage investment portfolios at a fraction of the cost of human financial advisors.

Meanwhile, commission-free trading apps like Robinhood have made investing accessible to millions who might never have bought stocks otherwise.

5. InsurTech

Insurance is being disrupted too. Companies like Lemonade use AI for instant quotes and claims, while peer-to-peer models let users pool resources for coverage.

6. Cryptocurrency & Blockchain

This is the most revolutionary (and controversial) corner of FinTech. Blockchain technology allows for decentralized financial systems without central banks. Crypto platforms like Binance and Coin base are just the tip of the iceberg; there’s also decentralized finance (DeFi), NFTs, and smart contracts.

The Benefits of FinTech

FinTech’s rise isn’t just about convenience it’s creating real-world benefits:

- Financial Inclusion

Billions of people worldwide are “unbanked” without access to traditional banking. FinTech can bring them into the economy via mobile accounts and digital payments. - Lower Costs

With fewer middlemen, transaction fees drop, making services more affordable. - Speed & Efficiency

Money moves faster. Loan approvals happen in hours, not weeks. - Personalization

AI-driven platforms can tailor services to individual needs from investment strategies to credit offers. - Transparency

Blockchain and open-banking APIs make it easier to see where your money goes.

Challenges and Risks in FinTech

It’s not all smooth sailing.

- Security Risks: More digital transactions mean more cyberattack targets.

- Regulatory Hurdles: Laws vary from country to country; navigating them can be tough for startups.

- Digital Divide: Not everyone has smartphones or reliable internet.

- Over-Reliance on Tech: What happens if your app goes down or your account gets hacked?

- Crypto Volatility: High rewards can come with high risks.

The Future of FinTech

Looking ahead, FinTech will only get more integrated into our daily lives. Here’s what’s coming:

- AI-Powered Financial Assistants

Imagine a Siri or Alexa that can optimize your savings, investments, and bills automatically. - Biometric Payments

Forget passwords your face, fingerprint, or even heartbeat could authorize payments. - CBDCs (Central Bank Digital Currencies)

Governments are experimenting with digital versions of national currencies. - Embedded Finance

Soon, you might be able to get a loan directly inside an online store’s checkout process. - Sustainable Finance

Apps will help people invest in environmentally friendly projects with full transparency.

How You Can Benefit from FinTech Today

- Download a budgeting app to track and optimize spending.

- Use a high-yield online savings account to earn better interest.

- Try micro-investing platforms to grow wealth gradually.

- Explore reputable crypto exchanges but only invest what you can afford to lose.

- Switch to lower-fee payment processors if you run a business.

Final Thoughts

FinTech isn’t a fad. It’s the natural evolution of money in the digital age. The companies leading this transformation aren’t just making banking faster or payments easier they’re redefining how humans interact with money altogether.

From rural farmers receiving mobile payments in Africa to teenagers investing spare change in stocks from their phones, FinTech’s reach is global and growing.

The future of finance is not in marble-floored bank branches; it’s in the apps we download, the algorithms we trust, and the blockchain networks quietly running behind the scenes.

In other words: The future of money isn’t coming. It’s already here and it fits in your pocket.

Business

Great Western Buildings Lawsuit Explained

Legal disputes in the construction and manufacturing industry often raise important questions about business practices, contract obligations, and customer trust. One such case that has attracted attention is the Great Western Buildings lawsuit. While many people search for quick answers, the topic deserves a deeper explanation to understand what led to the lawsuit, its broader impact, and the lessons it offers for the construction and metal building industry.

This article explains the Great Western Buildings lawsuit, including its possible causes, effects on customers and the industry, and the key takeaways businesses and consumers should learn from it.

Understanding Great Western Buildings

Great Western Buildings is a company associated with the metal and steel building industry, a sector known for providing pre-engineered structures for agricultural, commercial, and industrial use. Companies in this space typically offer services such as:

- Steel building manufacturing

- Custom building design

- Delivery and installation support

- Long-term warranties and maintenance guidance

Like many construction-related businesses, Great Western Buildings operated in a competitive environment where contracts, timelines, and quality standards are critical.

What Is the Great Western Buildings Lawsuit?

The Great Western Buildings lawsuit refers to legal claims involving disputes over business practices, contractual obligations, or project execution. Lawsuits of this nature often arise when one or more parties believe that agreements were not honored or expectations were not met.

Although lawsuits can involve multiple claims and perspectives, they generally revolve around issues such as:

- Contract disputes

- Alleged construction defects

- Project delays

- Financial disagreements

- Warranty or service-related concerns

It is important to note that lawsuits do not automatically imply wrongdoing. They are part of the legal system’s process for resolving disputes between parties.

Common Causes Behind Construction Lawsuits

To understand the Great Western Buildings lawsuit more clearly, it helps to look at common causes of lawsuits in the construction and building industry.

1. Contractual Disputes

Contracts define scope, cost, materials, timelines, and responsibilities. Lawsuits often arise when:

- Terms are unclear

- Deadlines are missed

- Payment schedules are disputed

Even small ambiguities can lead to major legal disagreements.

2. Quality and Construction Standards

Customers may raise legal concerns if they believe:

- Materials were substandard

- Workmanship did not meet industry standards

- The finished structure differed from agreed specifications

Quality-related disputes are among the most frequent in construction litigation.

3. Delays and Project Management Issues

Construction projects are time-sensitive. Delays caused by:

- Supply chain disruptions

- Labor shortages

- Poor coordination

can result in financial losses, leading affected parties to seek legal remedies.

4. Warranty and Post-Construction Support

Many building companies offer warranties. Disputes can arise when:

- Repairs are delayed or denied

- Warranty terms are misunderstood

- Responsibilities are disputed

These issues often escalate when communication breaks down.

Impact of the Great Western Buildings Lawsuit

Impact on Customers

Customers involved in or affected by legal disputes may face:

- Project delays

- Financial uncertainty

- Difficulty reselling or refinancing properties

- Stress related to unresolved claims

Even customers not directly involved may become cautious when researching the company.

Impact on the Company

For businesses, lawsuits can lead to:

- Legal expenses

- Reputational challenges

- Operational disruptions

- Increased regulatory scrutiny

Public perception plays a major role, especially in industries that rely on trust and long-term client relationships.

Impact on the Construction Industry

High-profile lawsuits often influence the broader industry by:

- Encouraging stricter contract standards

- Improving transparency

- Raising awareness about compliance and quality control

While legal disputes are disruptive, they can also push industries toward better practices.

How Lawsuits Affect Brand Reputation

In the digital age, news about lawsuits spreads quickly. Search results, online reviews, and social media discussions can shape public opinion long before a case is resolved.

For construction companies, reputation matters because:

- Projects involve large financial investments

- Clients rely heavily on trust

- Referrals play a major role in growth

This is why many companies now invest heavily in legal compliance, customer communication, and dispute prevention.

Legal Perspective: Why Construction Lawsuits Are Complex

Construction lawsuits are often complex due to:

- Multiple parties (manufacturers, contractors, subcontractors, clients)

- Technical engineering details

- Long project timelines

- Overlapping responsibilities

Courts usually rely on contracts, expert testimony, and documentation to determine outcomes. This complexity means cases can take months or even years to resolve.

Lessons for Businesses from the Great Western Buildings Lawsuit

1. Clear and Detailed Contracts

Contracts should:

- Use plain language

- Clearly define responsibilities

- Outline dispute resolution methods

Clear contracts reduce misunderstandings and legal risks.

2. Strong Quality Control

Regular inspections, material verification, and documented processes help prevent quality-related disputes.

3. Transparent Communication

Many lawsuits escalate due to poor communication. Keeping clients informed about delays, changes, or challenges builds trust and reduces conflict.

4. Proper Documentation

Maintaining records of:

- Emails

- Change orders

- Inspections

- Payments

can be crucial if disputes arise.

Lessons for Customers and Buyers

Customers can also reduce risk by:

- Carefully reviewing contracts

- Asking questions before signing

- Keeping written records

- Understanding warranty terms

An informed customer is better prepared to handle potential issues.

Is a Lawsuit the End of a Company?

Not necessarily. Many companies:

- Resolve disputes

- Improve operations

- Rebuild trust

A lawsuit can be a turning point rather than an endpoint, depending on how a company responds.

The Bigger Picture: Industry Accountability

Cases like the Great Western Buildings lawsuit highlight the importance of:

- Ethical business practices

- Accountability

- Legal compliance

They remind both companies and customers that transparency and fairness are essential in long-term business success.

Final Thoughts

The Great Western Buildings lawsuit serves as an important example of how legal disputes can arise in the construction and metal building industry. While lawsuits are complex and often misunderstood, they offer valuable lessons about contracts, communication, quality, and trust.

For businesses, the case underscores the importance of strong operational standards and legal preparedness. For customers, it highlights the value of due diligence and informed decision-making. Ultimately, such cases push the industry toward higher standards and better practices.

Frequently Asked Questions

What the Great Western Buildings lawsuit is about?

The Great Western Buildings lawsuit involves legal disputes related to contracts, project execution, quality concerns, or service issues commonly seen in the construction and metal building industry.

Whether a lawsuit means Great Western Buildings acted illegally?

A lawsuit does not automatically mean wrongdoing. It represents a legal claim or dispute, and responsibility is determined only after court decisions or settlements.

How construction lawsuits usually begin?

Construction lawsuits typically begin due to contract disagreements, project delays, quality or material concerns, payment disputes, or warranty-related issues.

How lawsuits can affect customers not directly involved?

Even customers not part of the lawsuit may experience indirect effects such as delayed projects, reduced confidence, or changes in company operations.

Whether construction lawsuits are common?

Yes, construction lawsuits are relatively common due to the complexity, cost, and long timelines involved in building projects.

What businesses can do to avoid similar lawsuits?

Businesses can reduce legal risks by using clear contracts, maintaining strong quality control, communicating transparently with clients, and keeping detailed documentation.

Whether customers should avoid companies involved in lawsuits?

Customers should research the situation carefully, review outcomes, and evaluate how the company addresses issues before making a decision.

Business

Finviz Explained: A Complete Guide to Stock Screening, Futures, and Market Analysis

In today’s fast-moving financial markets, having the right data at the right time can make all the difference. Traders and investors need tools that simplify complex market information and turn raw data into actionable insights. One such powerful platform is Finviz.

Finviz, short for Financial Visualizations, is widely used by traders, investors, and analysts to screen stocks, track futures, analyze market trends, and visualize financial data. Whether you are a beginner learning the basics or an experienced trader refining your strategy, Finviz offers tools that can significantly improve your decision-making.

This complete guide explains what Finviz is, how it works, and how to use its stock screening, futures data, and market analysis features effectively.

What Is Finviz?

Finviz is an online financial analysis platform designed to help users analyze stocks, futures, forex, and overall market performance using visual data and advanced filters. It aggregates information from multiple sources and presents it in a clean, easy-to-understand format.

The platform is best known for its:

- Powerful stock screener

- Interactive charts and heat maps

- Real-time futures and market data

- News aggregation and insider trading insights

Finviz is available in both free and paid (Finviz Elite) versions, making it accessible to a wide range of users.

Why Finviz Is Popular Among Traders and Investors

Finviz has gained popularity because it combines simplicity with depth. Unlike many complex trading platforms, Finviz does not require software installation and works directly in a web browser.

Key reasons traders use Finviz include:

- Fast stock filtering using dozens of criteria

- Visual representation of market trends

- All-in-one dashboard for stocks, futures, and news

- Time-saving analysis tools

Whether your goal is day trading, swing trading, or long-term investing, Finviz helps you spot opportunities quickly.

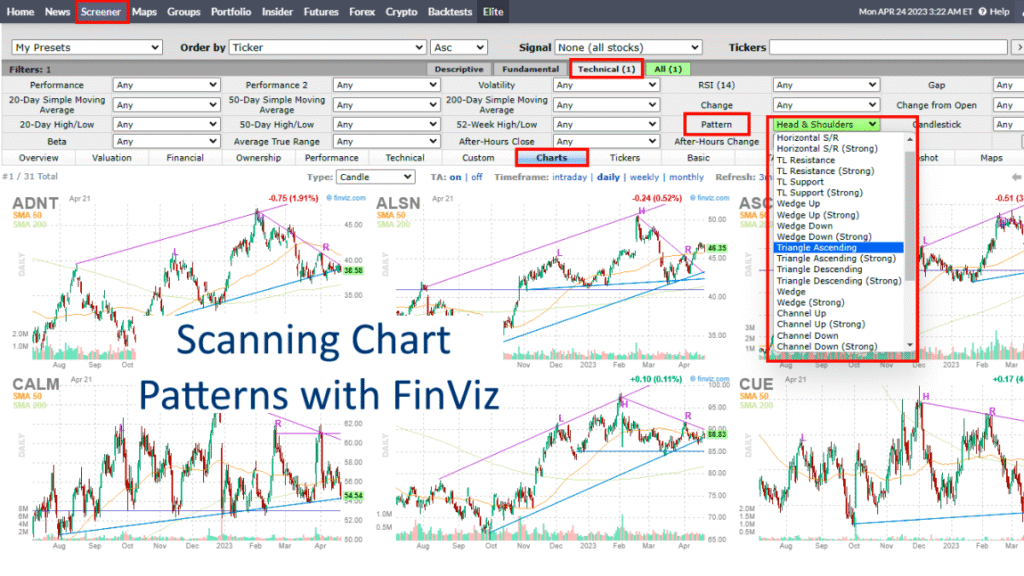

Understanding the Finviz Stock Screener

The Finviz stock screener is the platform’s most powerful feature. It allows users to filter thousands of stocks based on technical, fundamental, and descriptive criteria.

1. Descriptive Filters

These filters help narrow down stocks by general characteristics such as:

- Market capitalization

- Sector and industry

- Country and exchange

- Index inclusion

This is useful if you want to focus on specific markets, like U.S. tech stocks or small-cap companies.

2. Fundamental Filters

Fundamental analysis focuses on a company’s financial health. Finviz provides filters such as:

- Price-to-Earnings (P/E) ratio

- Earnings growth

- Revenue growth

- Dividend yield

- Debt-to-equity ratio

Long-term investors use these filters to find undervalued or fundamentally strong stocks.

3. Technical Filters

Technical traders rely heavily on price action and trends. Finviz offers filters like:

- Moving averages

- Relative Strength Index (RSI)

- Pattern recognition

- Support and resistance levels

- Volume and volatility

These filters are ideal for day traders and swing traders looking for momentum or breakout setups.

4. Using Presets and Custom Screens

Finviz provides built-in presets such as:

- Oversold stocks

- Top gainers

- New highs or lows

You can also save custom screeners, allowing you to reuse your strategy daily without rebuilding filters.

Finviz Charts and Visual Tools

Finviz stands out because of its visual approach to market data.

Interactive Stock Charts

Each stock has an interactive chart showing:

- Price movement

- Volume

- Technical indicators

- Pattern highlights

These charts help traders quickly identify trends without switching platforms.

Market Heat Maps

The heat map feature visually displays market performance by:

- Sector

- Industry

- Individual stocks

Green indicates gains, red indicates losses, and size represents market capitalization. This tool is excellent for spotting sector rotation and market sentiment at a glance.

Performance Maps

Performance maps show how stocks or sectors have performed over specific time frames, helping investors understand short-term and long-term trends.

Futures Data on Finviz

Finviz also provides valuable insights into futures markets, which are essential for understanding broader market direction.

Available Futures Markets

Finviz tracks major futures such as:

- S&P 500 futures

- Nasdaq futures

- Dow Jones futures

- Crude oil

- Gold and silver

- Agricultural commodities

This data is crucial for traders who want to anticipate market openings and global trends.

Why Futures Data Matters

Futures often move before stock markets open. By analyzing futures:

- Traders can predict market sentiment

- Investors can prepare for volatility

- Day traders can plan entries and exits

Finviz displays futures data in a simple format, making it accessible even for beginners.

Market News and Insider Trading Insights

Financial News Aggregation

Finviz pulls news from trusted financial sources and links headlines directly to relevant stocks. This allows users to:

- Stay updated on market-moving events

- React quickly to earnings or announcements

- Understand why a stock is moving

Insider Trading Data

One unique feature of Finviz is its insider trading section, which tracks:

- Insider buys and sells

- Transaction sizes

- Timing patterns

Finviz Free vs Finviz Elite

Free Version Features

The free version includes:

- Delayed quotes

- Basic stock screener

- Heat maps

- Market news

It’s perfect for beginners or casual investors.

Finviz Elite Features

Finviz Elite unlocks advanced tools such as:

- Real-time data

- Advanced charting

- Backtesting capabilities

- Exportable screening results

- No advertisements

Active traders often upgrade to Elite for speed, accuracy, and deeper analysis.

Who Should Use Finviz?

Finviz is suitable for a wide range of users:

- Beginners learning stock market basics

- Day traders looking for momentum stocks

- Swing traders identifying technical setups

- Long-term investors analyzing fundamentals

- Market analysts tracking overall trends

Its flexibility makes it a valuable tool regardless of trading style.

Pros and Cons of Finviz

Pros

- Easy-to-use interface

- Powerful stock screening

- Visual market analysis

- Free version available

- Covers stocks, futures, and news

Cons

- Limited backtesting in free version

- Not a trading execution platform

- Some data is delayed without Elite

Despite a few limitations, Finviz remains one of the most efficient market research tools available online.

Tips for Using Finviz Effectively

- Combine technical and fundamental filters for better results

- Use heat maps daily to track sector strength

- Save custom screeners for consistency

- Cross-check signals with other tools

- Avoid over-filtering, which can limit opportunities

With practice, Finviz can become a daily habit that improves your trading discipline.

Final Thoughts

Finviz is more than just a stock screener. It is a complete market analysis platform that brings together stock screening, futures data, charts, news, and visual insights in one place. Its intuitive design and powerful features make it suitable for both beginners and professionals.

If you want to save time, reduce noise, and make smarter market decisions, Finviz is a tool worth adding to your trading routine. Whether you use the free version or upgrade to Elite, the platform offers valuable insights that can help you stay ahead in today’s competitive financial markets.

Business

Business Software Gonzay Com: Smart Solutions for Technology, Health & Apps

In today’s fast-paced digital world, businesses are increasingly relying on smart software solutions to stay competitive, efficient, and customer-focused. Platforms like Business Software Gonzay Com are gaining attention for offering insights and solutions across technology, health software, and app development. Whether you are a startup founder, a small business owner, or a tech enthusiast, understanding how such platforms support modern industries can help you make informed decisions.

This article explores Business Software Gonzay Com, its focus areas, benefits, and how it contributes to the evolving digital ecosystem.

What Is Business Software Gonzay Com?

It appears to be an online platform focused on business-oriented software solutions, technology trends, digital health innovations, and application development. The platform aims to bridge the gap between complex technology and real-world business needs by offering simplified explanations, tools, and insights.

Its core purpose is to help businesses and individuals understand how software can improve operations, enhance productivity, and support innovation in multiple sectors.

Core Areas Covered by Business Software Gonzay Com

Business Software Gonzay Com mainly focuses on three growing domains:

- Technology Solutions

- Health-Related Software

- App and Software Development

Let’s explore each in detail.

1. Technology Solutions for Modern Businesses

Digital Transformation Support

Technology is the backbone of modern business success. Business Software Gonzay Com emphasizes digital transformation, helping companies move from manual systems to automated, cloud-based, and AI-driven solutions.

Key areas include:

- Cloud computing

- Business automation tools

- Data analytics

- Cybersecurity awareness

- Artificial intelligence integration

These technologies help businesses reduce costs, increase efficiency, and improve decision-making.

Business Management Software

Business Software Gonzay Com highlights tools designed for:

- Customer Relationship Management (CRM)

- Enterprise Resource Planning (ERP)

- Accounting and finance software

- Inventory and supply chain management

Such software solutions allow organizations to manage daily operations more effectively and maintain long-term growth.

Cybersecurity and Data Protection

With increasing cyber threats, data security is critical. The platform stresses:

- Secure software practices

- Data encryption

- Compliance awareness

- Risk management strategies

Businesses that prioritize cybersecurity not only protect their data but also build customer trust.

2. Health Technology and Software Solutions

The Rise of Digital Health

Health technology has transformed how medical services are delivered. Business Software Gonzay Com covers the growing field of health software, which includes digital tools designed to improve patient care, healthcare management, and medical data handling.

Healthcare Software Applications

Common health-related software solutions discussed include:

- Electronic Health Records (EHR)

- Telemedicine platforms

- Patient management systems

- Health monitoring applications

- Medical billing software

These tools help healthcare providers streamline operations and deliver better patient outcomes.

Benefits of Health Software

Health technology solutions provide:

- Faster access to patient data

- Improved accuracy in diagnosis

- Better communication between patients and doctors

- Cost reduction in healthcare operations

- Remote healthcare access

It emphasizes how digital health software supports both healthcare providers and patients in a modern, connected world.

Compliance and Data Privacy in Health Tech

Healthcare software must comply with strict data protection rules. The platform highlights the importance of:

- Secure patient data handling

- Ethical software development

- Privacy-focused system design

This is essential for maintaining trust and legal compliance in the healthcare industry.

3. App Development and Software Innovation

Importance of App Development Today

Mobile and web applications are now essential for business success. It focuses heavily on app development, helping users understand how apps drive engagement, sales, and brand visibility.

Types of Apps Covered

The platform discusses various app categories, including:

- Business productivity apps

- Health and fitness apps

- E-commerce applications

- Educational apps

- Custom enterprise solutions

Each app type serves specific business goals and user needs.

App Development Process Explained

It breaks down the app development lifecycle into simple stages:

- Idea and planning

- UI/UX design

- Front-end and back-end development

- Testing and debugging

- Deployment and maintenance

Understanding this process helps businesses plan their digital products more effectively.

Technologies Used in App Development

Common technologies discussed include:

- Programming languages like Java, Python, and JavaScript

- Frameworks for mobile and web apps

- Cloud-based app hosting

- API integration

- AI and machine learning features

These technologies enable scalable and future-ready applications.

Benefits

Easy-to-Understand Information

One major advantage of Business Software Gonzay Com is its focus on simplifying complex topics. This makes it useful for:

- Non-technical business owners

- Beginners in software development

- Entrepreneurs exploring digital tools

Multi-Industry Approach

By covering technology, health, and app development together, the platform provides a holistic view of how software impacts different industries.

Business Growth Support

The platform helps businesses:

- Identify suitable software solutions

- Understand digital trends

- Make informed technology investments

- Improve efficiency and scalability

Knowledge for Future Planning

With technology evolving rapidly, businesses must stay informed. Business Software Gonzay Com helps users:

- Prepare for digital innovation

- Adopt emerging technologies

- Stay competitive in changing markets

Why Technology, Health, and App Development Are Connected

These three areas are deeply interconnected:

- Technology enables innovation

- Health software improves quality of life

- App development delivers solutions directly to users

It highlights how combining these domains leads to smarter, more impactful digital products.

For example:

- Health apps rely on advanced technology

- Business software uses app platforms

- Data analytics improves healthcare decisions

This integrated approach reflects the future of digital solutions.

Who Can Benefit from Business Software Gonzay Com?

The platform is useful for:

- Small and medium business owners

- Healthcare professionals

- Startup founders

- Software developers

- IT managers

- Students learning technology concepts

Anyone interested in understanding how software drives modern industries can benefit.

Challenges and Considerations

While business software offers many benefits, Business Software Gonzay Com also emphasizes challenges such as:

- High development costs

- Data security risks

- User adoption issues

- Maintenance and updates

Understanding these challenges helps businesses plan better and avoid common mistakes.

The Future of Business Software and Digital Innovation

Looking ahead, Business Software Gonzay Com aligns with future trends such as:

- Artificial intelligence in healthcare

- Automation in business operations

- Cloud-based app ecosystems

- Personalized digital experiences

- Remote and mobile-first solutions

These trends indicate that software will continue to play a crucial role in shaping global industries.

Final Thoughts

Business Software Gonzay Com represents a modern approach to understanding and leveraging software in business, healthcare, and app development. By focusing on technology education, health innovation, and digital product development, the platform supports businesses and individuals navigating the digital age.

As industries become more technology-driven, platforms like Business Software Gonzay Com help simplify complex concepts and empower smarter decisions. Whether you’re planning to build an app, invest in health software, or modernize your business operations, understanding these interconnected domains is key to long-term success.

FAQ

What is Business Software Gonzay Com?

Business Software Gonzay Com is a platform that focuses on business technology, health software solutions, and app development insights.

Who can use Business Software Gonzay Com?

Entrepreneurs, startups, healthcare providers, developers, and business owners can benefit from its software-related content.

Does Business Software Gonzay Com cover health technology?

Yes, it highlights digital health tools such as telemedicine apps, patient management systems, and healthcare software solutions.

Why is app development important for businesses?

App development helps businesses improve customer engagement, streamline operations, and expand their digital presence.

Is Business Software Gonzay Com suitable for small businesses?

Yes, it provides easy-to-understand information useful for startups and small businesses exploring digital tools.

-

Fashion6 months ago

Fashion6 months agoWhy ’90s Fashion Still Dominates Today’s Style Scene

-

Fashion6 months ago

Fashion6 months agoTop Fashion Trends to Follow in August 2025

-

How-to Guides6 months ago

How-to Guides6 months agoHow to Restore Pantone Colors in New Illustrator Versions (2026 Guide)

-

Politics6 months ago

Politics6 months agoReddit Politics: A Deep Dive into Online Political Discourse

-

How-To Tutorials & Troubleshooting6 months ago

How-To Tutorials & Troubleshooting6 months agoHow to Screenshot on Mac: The Complete 2025 Guide